Renters Insurance in and around Klamath Falls

Your renters insurance search is over, Klamath Falls

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a townhome or an apartment, protection for your personal belongings is a wise idea, especially if you could not afford to replace lost or damaged possessions.

Your renters insurance search is over, Klamath Falls

Coverage for what's yours, in your rented home

There's No Place Like Home

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented apartment include a wide variety of things like your tablet, desk, exercise equipment, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Rachael Spoon has the efficiency and experience needed to help you evaluate your risks and help you protect your belongings.

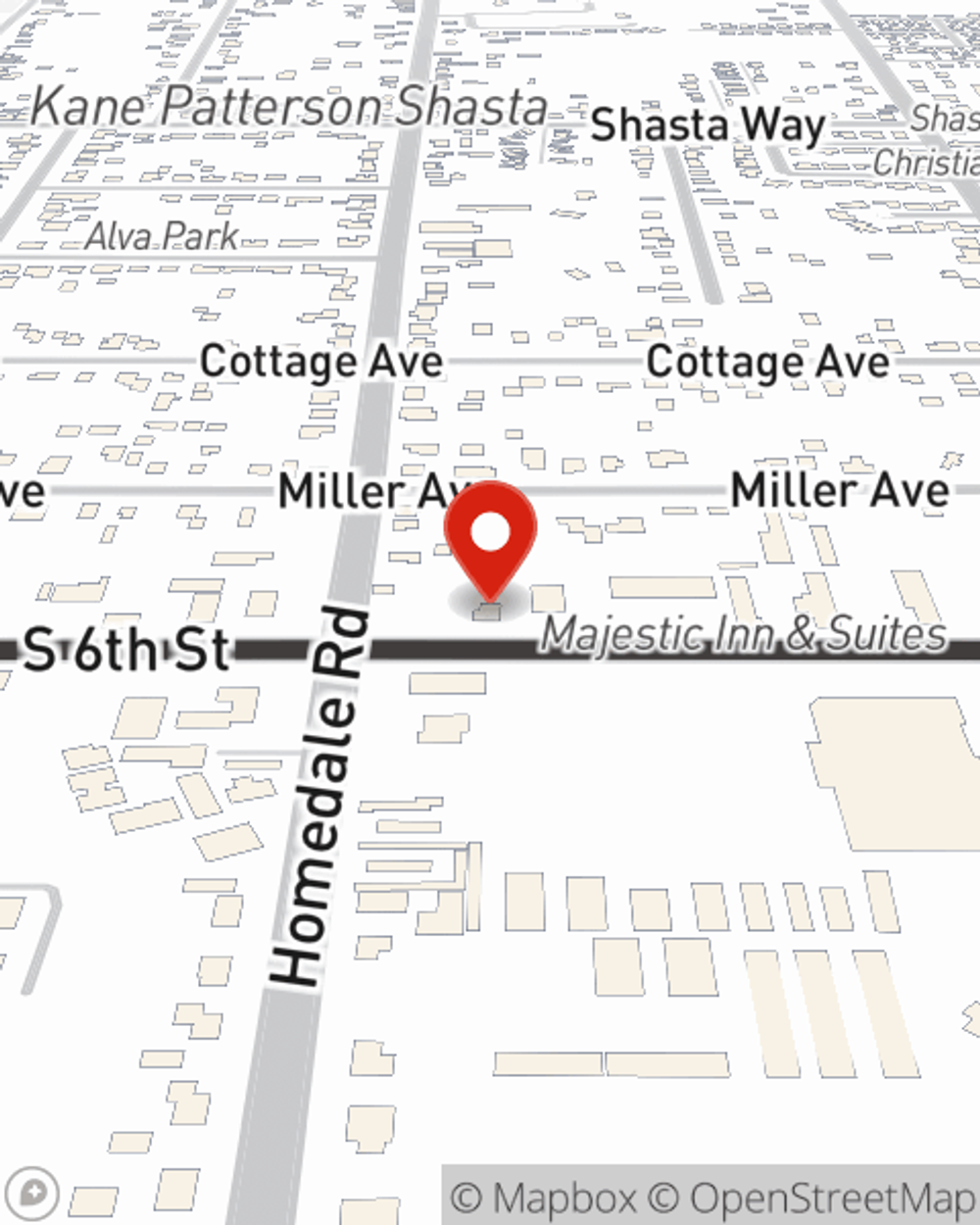

Renters of Klamath Falls, reach out to Rachael Spoon's office to discover your individual options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Rachael at (541) 884-6265 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Rachael Spoon

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.